capital gains tax news today

There are a few higher rates for particular items but they dont apply to a home sale. Coming into a fair amount of money from selling a.

State Taxes On Capital Gains Center On Budget And Policy Priorities

The estate tax exclusion will grow in 2023 to 1292 million from 1206 million in 2022.

. Long-Term Capital Gains Taxes. Capital Gains Tax News Service from EIN News. If you want to avoid that you should choose long-term investments instead.

Iowas economy has continued to perform well with revenue growth of more than 1 billion. By Harry Brennan 5 Aug 2021. The combined rate would be 567 in California and 543 in New.

The combined capital gains levy would be even higher if you include similar taxes imposed by most states. Capital gains taxes on assets held for a year or less correspond to ordinary income tax. That means that until your estate exceeds 1292 million you will not owe any tax.

For 2023 you may qualify for the 0 long-term capital gains rate with taxable income of 44625 or less for single filers and 89250 or less for married couples filing jointly. Republicans waging war against President Bidens proposed tax increases are increasingly focusing their opposition on one floated change to capital gainsBiden has called. Set Up FREE Account Submit Release.

The administration has proposed nearly doubling the long-term capital gains tax rate to 396 for households with 1 million or more in annual earnings. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or 20 long.

The top federal tax rate on capital gains could reach levels not seen since the 1970s under the House Democrats proposed 35. The long-term capital gains tax rate varies between 0 15 and 20. About News by Country.

Set Up FREE Account Submit Release. Kitco News After becoming one of the most crypto-friendly nations in Europe with no crypto tax on individuals Portugal is now looking into the idea of a 28 capital. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income.

Capital gains tax take hits 10bn use these tricks to pay less. Today News Capital Gains Tax can often be an unexpected expense on what is usually a joyous occasion. By holding an investment for a year or more you will qualify for long-term capital gains tax rates.

Record amount paid by investors which is likely to increase in the coming years. Capital Gains Tax News Service from EIN News. It has also suggested.

Published 7 days ago. The Department of Revenue DOR this week responded to the October 5 letter from the Citizen Action Defense Fund CADF asking the agency to cease and desist its capital. Iowas economy continues to perform well tax policies will slow revenue growth in coming years.

September 15 2021 455 PM MoneyWatch.

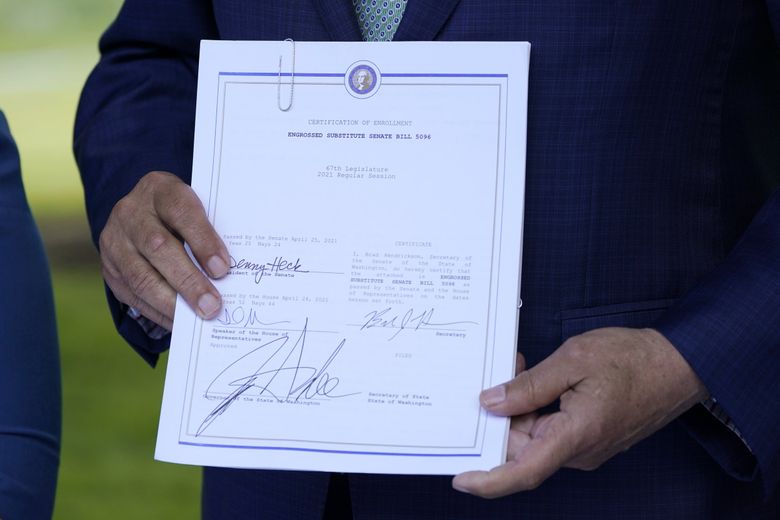

Inslee Signs Off On Capital Gains Tax For Wealthy And Tax Rebate For Lower Income Workers In Washington The Seattle Times

Explainer Capital Gains Tax Hike Targets Wealthy Investors Ap News

Wealthy Donors Grow War Chest For Pac Seeking To Overturn State S Capital Gains Tax Mynorthwest Com

House Democrats Capital Gains Tax Rates In Each State Tax Foundation

A Capital Gains Tax For Seattle New Progressive Revenue Measure Enters The Conversation The Urbanist

Capital Gains Tax Under The American Families Plan Marcum Llp Accountants And Advisors

Capital Gains Tax Rate Map By State Under The New Tax Proposal

Opinion Uw Tax Law Professor On New Capital Gains Income Tax It S Going To Be Found Unconstitutional Clarkcountytoday Com

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate

What Are The Capital Gains Tax Rates For 2022 Vs 2021 Avitas Capital

Capital Gains Taxes Are Going Up Tax Policy Center

Voters Overwhelmingly Give Thumbs Down To Capital Gains Tax Association Of Washington Business

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

12 Ways To Beat Capital Gains Tax In The Age Of Trump

How Could Changing Capital Gains Taxes Raise More Revenue

How Are Capital Gains Taxed Tax Policy Center

Wealthy Would Dodge 90 Of Biden S Capital Gains Tax Increase Study Says Cbs News

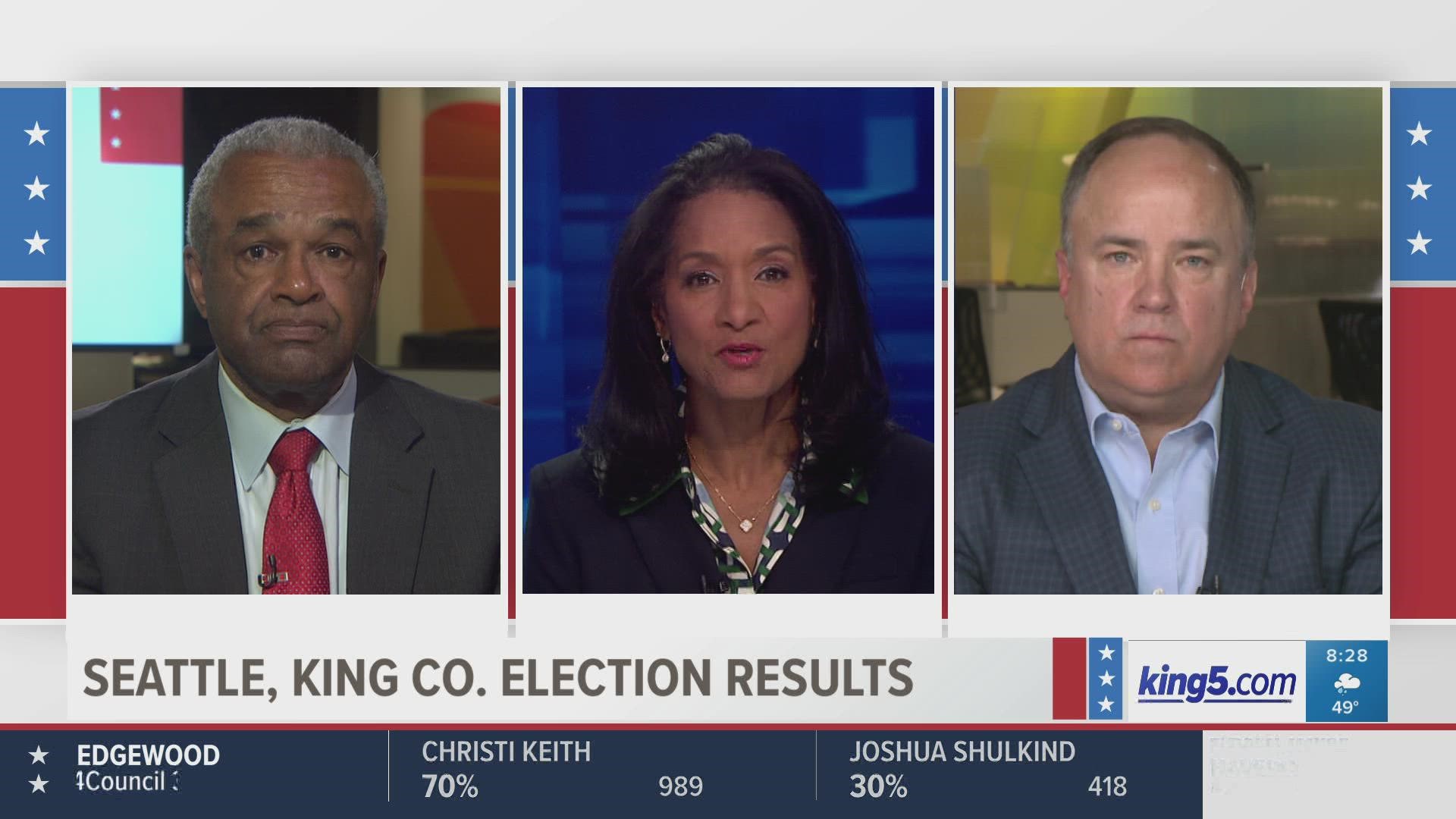

Washington Advisory Vote 37 Results On Capital Gains Tax King5 Com

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)